You’d be surprised by how many people earning over £100,000 are not aware that they need to do a tax return. In fact, it catches loads of people out year on year because having to do a tax return for being a high earner is not widely publicised by HMRC. They’re not deliberately trying to catch you out, but they do assume that it’s common knowledge.

And if we can be sure of anything to do with tax, it’s that very little is common knowledge to anyone but accountants!

What changes when you earn over £100k?

Let’s first talk about the Personal Allowance. The Personal Allowance lets you earn the first portion of your income tax-free. In the 2021/22 tax year, this portion is the first £12,570 that you earn. People that earn less than £12,570 don’t pay Income Tax on their earnings.

When your income is higher than £100,000, your eligibility for the Personal Allowance reduces on a sliding scale. And this affects you if you’re employed, self-employed, employed and self-employed etc. Basically, no matter what tips your overall earnings over the £100,000 threshold, you’ll still be affected by this rule.

For every £2 that you earn over £100,000, you lose £1 of your Personal Allowance. This change in your taxable income is called your adjusted net income. When you reach £125,140, you lose your tax-free entitlement totally.

Why do I need to do a tax return?

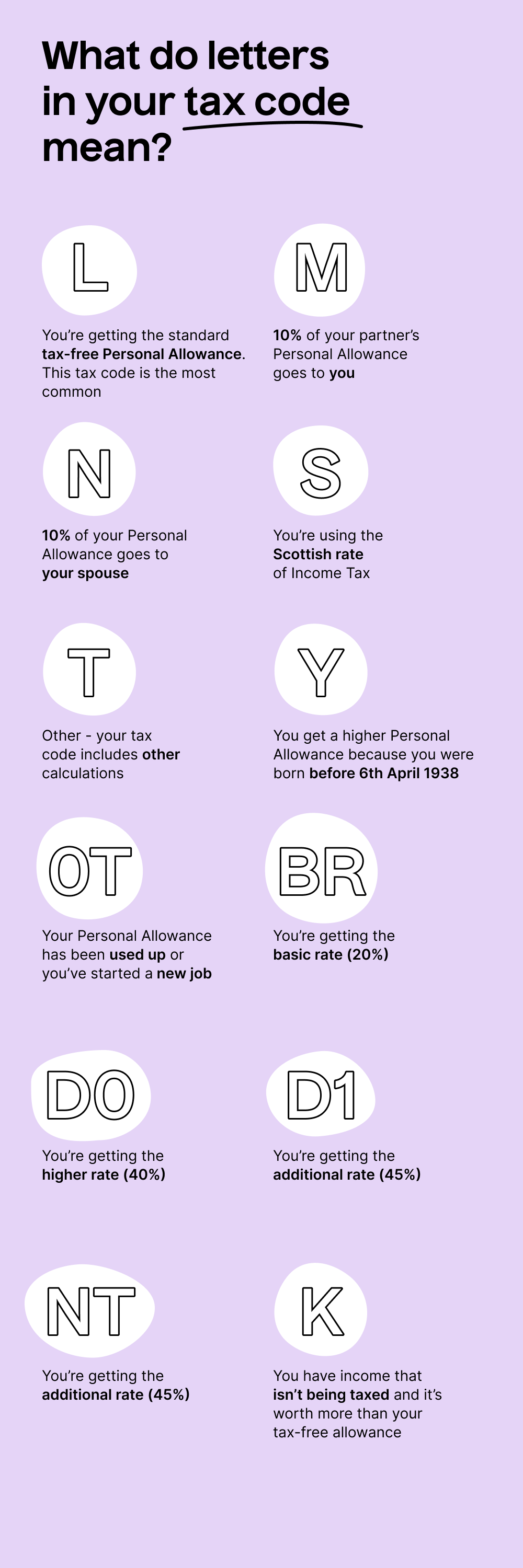

HMRC need to check that your adjusted net income is correct. They estimate the tax you should be paying via your tax code. But if your tax code is wrong, you could be hit with a hefty tax bill each January.

What most people also don’t know is that ensuring that you’re on the right tax code is your responsibility, not HMRC’s 🤯

We therefore recommend that you check your tax code at the start of each tax year to make sure that you’re on the right one. Also if HMRC ever issue you with a new code, you should get in touch with them to make sure that it’s the correct one based on your circumstances. That allows you to get it sorted as early as possible, in case you do in fact owe money.

Things to be aware of

- Being taxed via a salary (PAYE) doesn’t guarantee that you’re on the right tax code

- The earlier you do your tax return, the sooner you know what you’ll owe (or be owed) on 31st January

- When you earn between £100,000 and £125,700, you pay 60% tax – here’s what you can do to avoid it

- If you owe less than £3,000 in tax, you can pay this via PAYE if you file by 30th December but be careful doing this if you were on the wrong tax code because it may cause more confusion

- Things that can tip your income over the £100,000 mark without you realising are:

- Bonuses

- Company shares vesting

Our advice?

Get your tax return sorted as early as possible after the new tax year begins so that you can get prepared to save, should you need to.